Management evaluates the percentage of an invoice dollar rob stone amount that becomes bad debt per period and then applies the percentage to the current period’s aging reports. The accounts receivable aging report can also indicate which customers are becoming a credit risk to the company. Older accounts receivable expose the company to higher risk if the debtors are unable to pay their invoices. The aging method usually refers to the technique for estimating the amount of a company’s accounts receivable that will not be collected. The estimated amount that will not be collected should be the credit balance in the contra asset account Allowance for Doubtful Accounts. The debit balance in Accounts Receivable minus the credit balance in Allowance for Doubtful Accounts will result in the estimated amount of the receivables that will be converted to cash.

Accounts receivable aging reports may be mailed to customers along with the month-end statement or a collection letter that provides a detailed account of outstanding items. Therefore, an accounts receivable aging report may be utilized by internal as well as external individuals. The findings from accounts receivable aging reports may be improved in various ways. If a company experiences difficulty collecting accounts, as evidenced by the accounts receivable aging report, problem customers may be required to do business on a cash-only basis. Therefore, the aging report is helpful in laying out credit and selling practices. Companies rely on this accounting process to figure out the effectiveness of its credit and collections functions and to estimate potential bad debts.

The net of these two account balances is the expected amount of cash that will be received from accounts receivable. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. If the Allowance for Doubtful Accounts has a balance from the previous month, the journal entry will be done for the difference between the current balance and the desired balance. Accounting software will likely have a feature that generates the aging of accounts receivable. For instance, if payment was due on January 15th, and it’s now January 25th, you would mark it as being 10 days past due. For example, you may allow clients to pay for goods 30 days after they’re delivered.

Access and download collection of free Templates to help power your productivity and performance. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Allowance for Doubtful Accounts

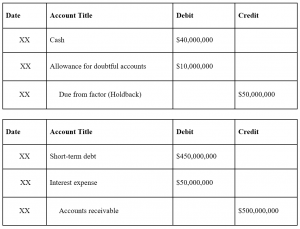

When estimating the amount of bad debt to report on a company’s financial statements, the accounts receivable aging report is used to estimate the total amount to be written off. This breakdown shows the distributor that a significant portion of receivables is in the days category, signaling potential issues with those specific customers. The distributor can then focus on collecting from customers in this category, implementing targeted collection strategies to improve cash flow and reduce the risk of bad debts. Under the Aging of Accounts Receivable Method, the estimate is updated at the end of each accounting period so it is based on the most recent Accounts Receivable Aging Report. The following examples show the journal entries when the account has a zero balance, a credit balance, or a debit balance.

- If the aging report shows a lot of older receivables, it means that the company’s collection practices are weak.

- Older accounts receivable expose the company to higher risk if the debtors are unable to pay their invoices.

- When this entry is posted in the Allowance for Doubtful Accounts account, the balance will now be a credit balance of $4,905–the desired balance.

What is Accounts Receivable Aging?

If your business chooses to factor in outstanding invoices (i.e., sell debts from credit sales for someone else to collect), AR aging reports are a necessary piece of documentation. If you do end up incurring a bad debt expense, you’ll need to provide evidence in the form of accounts receivable aging reporting (along with other documentation). An aging report provides information about specific receivables based on the age of the invoices. It gives the management team a historical overview of the company’s receivables portfolio. It groups outstanding invoices based on the duration they’ve been due and unpaid. A company uses the Accounts Receivable Aging Report to determine the amount of the estimate for Allowance for Doubtful Accounts.

How Management Uses Accounts Receivable Aging

This will result in the balance sheet reporting Accounts Receivable (Net) of $82,000. Creating an aging report for the accounts receivables sorts the unpaid customers and credit memos by date ranges, such as due within 30 days, past due 31 to 60 days, and past due 61 to 90 days. Management uses the information to help determine the financial health of the company and to see if the company is taking on more credit risk than it can handle. Companies will use the information on an accounts receivable aging report to create collection letters to send to customers with overdue balances.

How Accounts Receivable Aging Works

Accounts receivable aging schedule is a table which groups the accounts receivable of a company by their age in certain ranges / time periods of days, weeks, months etc. In other words, an aging schedule of receivables classifies the accounts receivable into groups by the date they became due and sometimes, by the date they were created. Company A typically has 1% bad debts on items in the 30-day period, 5% bad debts financial modeling best practices in the 31 to 60-day period, and 15% bad debts in the 61+ day period. The most recent aging report has $500,000 in the 30-day period, $200,000 in the 31 to 60-day period, and $50,000 in the 61+ day period.